Wealth Isn’t Luck—It’s These 9 Money Habits

Most people assume wealth is about earning more, but the truth is, it’s about how you handle the money you already have. The rich aren’t just lucky—they follow specific habits that grow their wealth over time, while everyone else unknowingly falls into money traps that keep them stuck. The good news? Anyone can adopt these habits. Whether you’re tired of living paycheck to paycheck or just want to build lasting financial security, these 9 money habits can completely change your financial future—no lottery ticket required.

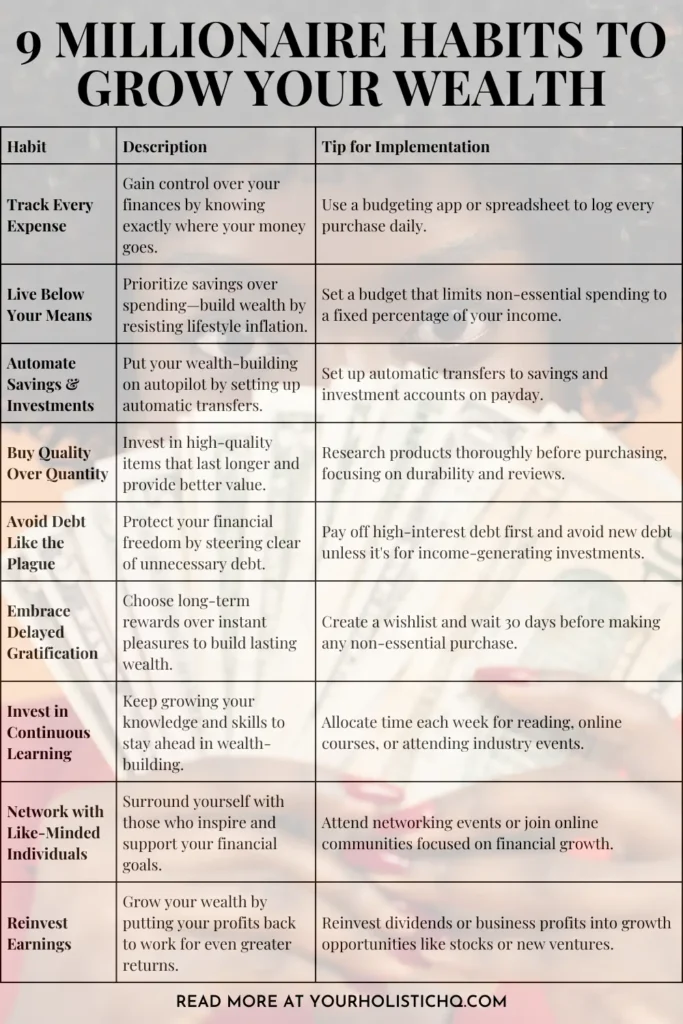

- 1. Pay Yourself First – The Habit That Builds Wealth Automatically

- 2. Track Every Dollar – Control Your Money or It Will Control You

- 3. Avoid Lifestyle Creep – Why More Income Doesn’t Mean More Wealth

- 4. Invest Consistently – Let Your Money Work Harder Than You Do

- 5. Use Debt Wisely – The Difference Between Rich and Broke Thinking

- 6. Prioritize Earning More – The Fastest Path to Financial Freedom

- 7. Think Long-Term – How Delayed Gratification Builds Lasting Wealth

- 8. Surround Yourself with Wealth-Minded People – Why Your Circle Matters

- 9. Take Smart Risks – The Key to Breaking Out of the Paycheck Cycle

- Final Thoughts

1. Pay Yourself First – The Habit That Builds Wealth Automatically

Most people struggle to save because they do it backward, spending first and saving whatever is left. But wealthy people follow a different rule—they pay themselves first. Before covering bills, groceries, or entertainment, they automatically set aside money for savings and investments. This simple shift forces financial growth instead of hoping there’s something left at the end of the month.

Studies show that when saving is optional, most people skip it, assuming they’ll start later when they make more money. But income isn’t the issue—behavior is. Expenses always rise to match earnings unless a system is in place to prevent it. By making savings automatic, the decision is removed, and wealth grows effortlessly over time.

To apply this habit, set up an automatic transfer to savings or investments before spending anything. Start with any percentage you can afford and increase it over time. Treat it like a non-negotiable bill, just like rent or utilities. Those who master this habit consistently build wealth, proving that financial security isn’t about luck—it’s about making saving a priority.

2. Track Every Dollar – Control Your Money or It Will Control You

Many people have no idea where their money actually goes. They assume they’re just covering necessities, yet somehow, their bank account drains faster than expected. Without tracking spending, financial leaks go unnoticed, and money slips through the cracks. Wealthy people don’t let their money wander—they track every dollar to stay in control.

Psychological studies reveal that people tend to underestimate their expenses, especially on small, frequent purchases. A few dollars here and there might seem harmless, but over time, they add up to thousands. Tracking spending isn’t about restriction—it’s about awareness. When you know exactly where your money goes, you can redirect it toward things that build wealth instead of mindless consumption.

To implement this, start by reviewing your last three months of expenses. Identify patterns, cut unnecessary spending, and set a clear budget. Use an app, a spreadsheet, or even a notebook—what matters is consistency. The simple act of tracking your money forces better decisions, turning financial chaos into financial control.

3. Avoid Lifestyle Creep – Why More Income Doesn’t Mean More Wealth

Earning more money should make life easier, yet many people find themselves just as stressed about finances as they were before. This is because as income rises, so do expenses—a phenomenon known as lifestyle creep. Instead of using extra money to build wealth, people upgrade their homes, cars, and daily habits, leaving them stuck in the same financial cycle.

Studies show that people quickly adapt to a higher standard of living, making luxuries feel like necessities. A salary increase that once felt life-changing becomes normal within months. Meanwhile, wealthy individuals take a different approach—they resist the urge to inflate their spending and instead funnel extra income into savings, investments, or assets that generate more wealth.

To break the cycle, create a rule for any income increase: allocate a set percentage to wealth-building before considering lifestyle upgrades. Delay big purchases and ask yourself if they truly improve your life or just add financial pressure. The difference between staying stuck and building lasting wealth isn’t how much you earn—it’s how much you keep.

4. Invest Consistently – Let Your Money Work Harder Than You Do

Most people rely solely on their paycheck, exchanging time for money without realizing they’re stuck in a cycle that can never lead to real wealth. Meanwhile, the wealthy understand a critical rule—money should work for you, not the other way around. The key to financial freedom isn’t just saving but investing consistently so that money grows on its own.

Studies show that long-term investing, even in small amounts, is the most effective way to build wealth. The power of compound interest turns even modest investments into substantial sums over time. Yet many hesitate, waiting for the “perfect time” to start or fearing short-term market fluctuations. Wealthy individuals ignore the noise and invest regularly, knowing that time in the market matters more than timing the market.

The simplest way to start is by automating investments. Whether it’s index funds, real estate, or a retirement account, the habit of putting money into assets consistently is what separates those who build wealth from those who struggle financially, no matter how much they earn.

5. Use Debt Wisely – The Difference Between Rich and Broke Thinking

Most people see debt as a burden, but the wealthy see it as a tool. The difference isn’t just in how much debt they take on—it’s in the kind of debt they choose. Bad debt drains wealth, trapping people in endless payments for things that lose value. Good debt, when used strategically, builds wealth by funding investments that generate returns.

Studies show that the average person’s debt is mostly consumer-driven—credit cards, car loans, and high-interest financing that keeps them financially stuck. Meanwhile, wealthy individuals use debt differently. They finance assets like real estate, businesses, or investments that generate income, rather than liabilities that take money out of their pockets.

To shift your financial future, avoid debt that doesn’t pay you back. Pay off high-interest loans aggressively and think twice before financing lifestyle upgrades. Instead, learn how to leverage low-interest, strategic debt to invest in things that grow your wealth. The key difference between those who struggle and those who thrive isn’t avoiding debt—it’s knowing which kind to take on.

6. Prioritize Earning More – The Fastest Path to Financial Freedom

Most people focus on cutting expenses to improve their finances, but there’s a limit to how much you can save. Meanwhile, the wealthy focus on increasing income, knowing that earning more creates far greater financial freedom than budgeting alone ever could.

Psychological studies show that people often settle for their current earnings, assuming they have no control over their financial ceiling. But those who build wealth take proactive steps to increase their income—whether through salary negotiation, career advancement, high-income skills, or additional income streams like side businesses or investments. The difference is mindset and action, not luck.

To apply this habit, shift your focus from just saving money to making more of it. Ask for raises, develop skills that increase your value, and explore ways to generate passive income. Financial success isn’t just about spending less—it’s about creating a bigger financial foundation so that money is never a source of stress.

7. Think Long-Term – How Delayed Gratification Builds Lasting Wealth

Short-term pleasure is the biggest threat to long-term wealth. The constant urge to upgrade cars, book lavish vacations, or chase the next luxury purchase keeps many people financially stuck. Meanwhile, those who build real wealth take the opposite approach—they prioritize future financial security over instant gratification, knowing that today’s small sacrifices lead to far greater rewards.

Behavioral studies reveal that the ability to delay gratification is one of the strongest predictors of financial success. Those who resist impulse spending and focus on long-term growth—through investments, savings, and strategic decisions—accumulate significantly more wealth over time. In contrast, impulsive financial choices often lead to years of unnecessary debt and financial stress.

To build this habit, pause before every major financial decision and ask: Will this benefit me long-term, or is it just for temporary satisfaction? The difference between those who struggle and those who thrive financially isn’t how much they earn—it’s whether they prioritize future wealth over fleeting indulgences.

8. Surround Yourself with Wealth-Minded People – Why Your Circle Matters

The people around you influence your financial habits more than you realize. Studies show that income levels, spending behaviors, and even financial beliefs are often a reflection of the people you spend the most time with. Those who build wealth intentionally seek out mentors, friends, and communities that encourage financial growth rather than reckless spending.

When surrounded by people who normalize overspending, debt, and instant gratification, it becomes easy to fall into the same patterns. On the other hand, being around those who invest, budget wisely, and pursue financial independence naturally reinforces smarter money habits. Environment shapes behavior, and financial success is no exception.

To apply this habit, start engaging with content, books, and communities that challenge your mindset about money. Seek out people who have achieved the financial stability you want, whether through networking, online communities, or mentorships. Wealth isn’t just about knowledge—it’s about being in an environment that makes smart financial choices feel normal.

9. Take Smart Risks – The Key to Breaking Out of the Paycheck Cycle

Playing it safe with money might feel comfortable, but it rarely leads to financial freedom. Those who build wealth understand that calculated risks create opportunities—whether in investing, career moves, or business decisions. Avoiding risk altogether often means staying trapped in the same financial patterns, never making real progress.

Psychological studies show that fear of loss is more powerful than the desire for gain, which is why many people hesitate to invest, start a business, or make bold career changes. Meanwhile, the wealthy embrace informed risks, knowing that every major financial breakthrough requires stepping outside their comfort zone. They don’t gamble—they research, plan, and take action despite uncertainty.

To develop this habit, start by shifting your mindset around risk. Instead of asking, “What if I fail?” ask, “What if this works?” Educate yourself on smart financial risks like investing, entrepreneurship, and high-income skills. The difference between those who stay stuck and those who build wealth isn’t luck—it’s the willingness to take well-calculated risks that open doors to financial growth.

Final Thoughts

Wealth isn’t a matter of luck—it’s built through consistent habits and intentional decisions. While many people believe financial success is reserved for a select few, the truth is that anyone can build wealth by changing how they manage money. The difference between those who thrive and those who struggle isn’t income level—it’s how they handle the money they already have.

By applying these nine money habits, you shift from financial survival to financial growth. Paying yourself first ensures you always save. Tracking your spending gives you control. Avoiding lifestyle creep stops money from slipping away. Investing, using debt wisely, and earning more create lasting security. Long-term thinking, surrounding yourself with the right influences, and taking calculated risks open doors to greater financial opportunities. Each habit compounds over time, leading to a future where money is a tool—not a source of stress.

Financial freedom isn’t built overnight, but every smart decision brings you closer. The key is to start now—whether it’s automating savings, investing consistently, or learning new skills to increase your income. Small, intentional changes today will shape a future where you have more choices, more security, and more control over your financial destiny.